About IFE-2-Leave No One Behind

Through research and implementation of innovative financing approaches, the IFE-2-Leave No One Behind project aims to have the following impact on the field of global education:

- An increased amount of financing, effectiveness and cost-efficiency of education programmes which improve the educational opportunities for marginalised and vulnerable children and youth.

- Evidence-based policy dialogue on the use of innovative finance mechanisms for reaching vulnerable and marginalised groups in low, lower-middle-income, as well as fragile and conflict-affected countries.

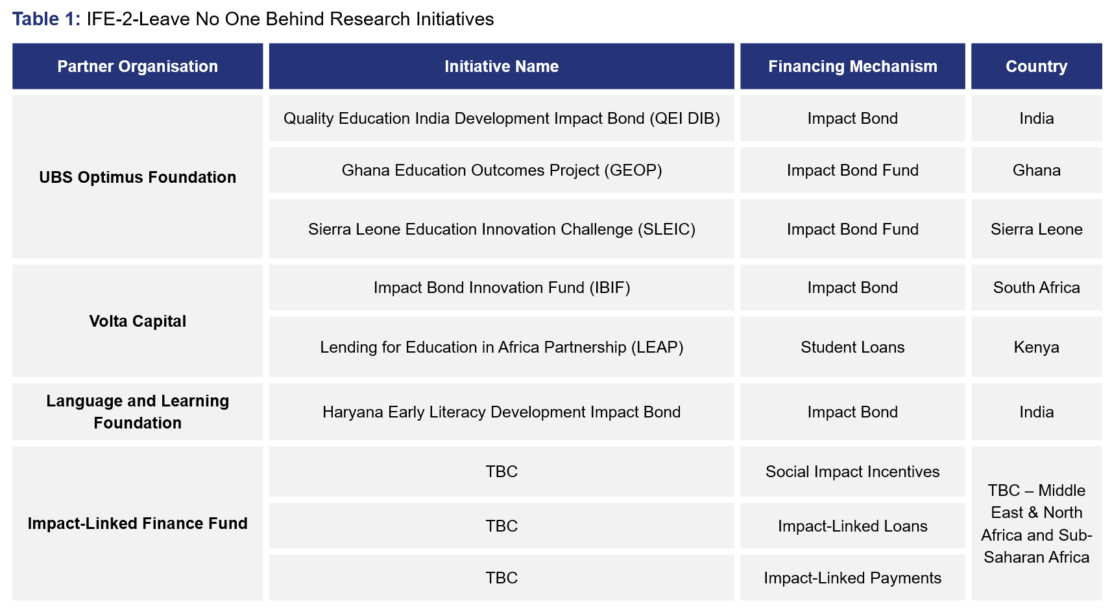

The IFE-2-Leave No One Behind project funds the implementation and qualitative impact evaluation research on initiatives managed by UBS Optimus Foundation (UBS OF), Volta Capital and Language and Learning Foundation in India, Ghana, Sierra Leone, South Africa, Kenya and Rwanda (see Table 1).

In August 2023, the analysis of three additional mechanisms was added to the IFE-2-Leave No One Behind research framework – Social Impact Incentives, Impact-Linked Loans, and Impact-Linked Payments implemented by Impact-Linked Finance Fund to finance private social enterprises.

The research is conducted by three university partners – NORRAG, the Global Education Centre of the Geneva Graduate Institute, the Bertha Centre at the University of Cape Town-Graduate School of Business (UCT-GSB) in Cape Town, and the Centre of Excellence in Teacher Education (CETE) at the Tata Institute of Social Sciences (TISS) in Mumbai. The mixed-method impact research centres on whether, how and under what conditions innovative finance mechanisms, arrangements, and programme elements are likely to produce additional financing and educational benefits for vulnerable and marginalised student populations.

The research component of the project tests the following hypothesis:

Innovative financing mechanisms contribute to additionality in education financing. Mechanisms that focus on outcomes, adopt private sector management principles and utilise the private capital market to increase the financing available to reach the targets for SDG4 for quality education (Leave No One Behind).

The overall research questions being examined are:

- To what extent and why do impact bonds and the social lending scheme produce better development results in education (in particular for the marginalised population) than traditional funding approaches? Does the introduction of financial returns into education service delivery lead to the exclusion of the hardest population to reach? Does the concept of outcome-based funding provide the adequate incentives in order to foster quality education in our partner countries?

- Are innovative financing mechanisms more cost-efficient than traditional funding in education, including all related costs (for example costs for setting up and managing the impact bonds, returns to be paid to the investors, etc.)? Does outcome-based payment improve intervention effectiveness in education? In case the innovative financing mechanisms are costlier, is the higher cost of the innovative financing mechanism compensated by improved effectiveness?

- Does engaging private investors reduce and/or transfer financial risks for social development projects to private investors, and thereby increase the efficiency of public funding? What are the different types of risks born by various stakeholders (national governments, bilateral and multilateral donors, private investors, service providers and beneficiaries) with the introduction of private investment?

- Are innovative financing mechanisms attracting new funds into education and under which conditions? Can innovative financing increase long term education funding and improve the quality of interventions for SDG4?

- Can impact bonds and the social lending scheme create productive public-private collaborations in education that can be maintained beyond investment timeframes? Can impact bonds and the social lending scheme have a systemic impact? Are the new approaches tested within the impact bonds/the social lending scheme being taken up and replicated at the level of a country’s education system?

- What are expected, unexpected and achieved overall outcomes (ecosystem change, capacity strengthening, policy reform etc.), especially beyond the stated educational outcomes, of the innovative financing mechanisms in education?

Research approach and methodology

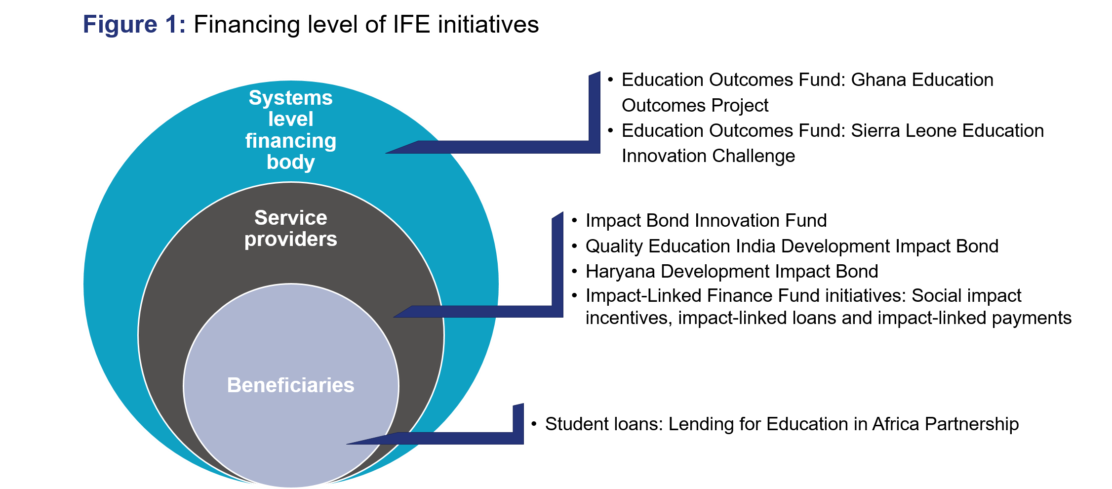

The nine initiatives included in the research differ in proximity to the ultimate beneficiary population (Figure 1). These initiatives use a wide range of innovative finance mechanisms to bring additional financing to education and to improve the efficiency and effectiveness of education programming. These include:

- Direct education loans to youth in Sub-Saharan Africa (LEAP)

- Stand-alone impact bonds (IBIF, QEI DIB and Haryana Early Literacy DIB) as well as social impact incentives, impact-linked loans and impact-linked payments for service providers who then deliver education programmes to the target populations

- Impact bond funds (GEOP and SLIEC) that catalyse pooled results-based financing from donors and governments to finance programmes for the beneficiaries through multiple service providers.

To evaluate the impact of innovative financing on bringing more and better financing for SDG 4 (inclusive and equitable quality education) IFE-2-Leave No One Behind uses a contribution analysis approach to systematically gather evidence on causal mechanisms and examine whether the financing approach has added value or other factors are causing the results. The mixed-method data collection and analysis is conducted using qualitative and quantitative methods to develop formative and summative evaluations. The individual initiative impact evaluations feed into a meta-evaluation, which combines the findings to determine how the key features of innovative financing contribute towards bringing additional funds to the sector and/or improving the effectiveness of existing funds in reaching the targets of SDG 4.