Event Highlights - Launch of NSI 05 Domestic Financing: Tax and Education

The launch of NORRAG Special Issue 05 (NSI 05) – “Domestic Financing: Tax and Education” was held online on 23 November 2020. NSI 05 focuses on education’s main source of funding: taxes. As a collection of 25 articles, it aims to bridge the gap between theory and practice as well as advocacy and policy in education.

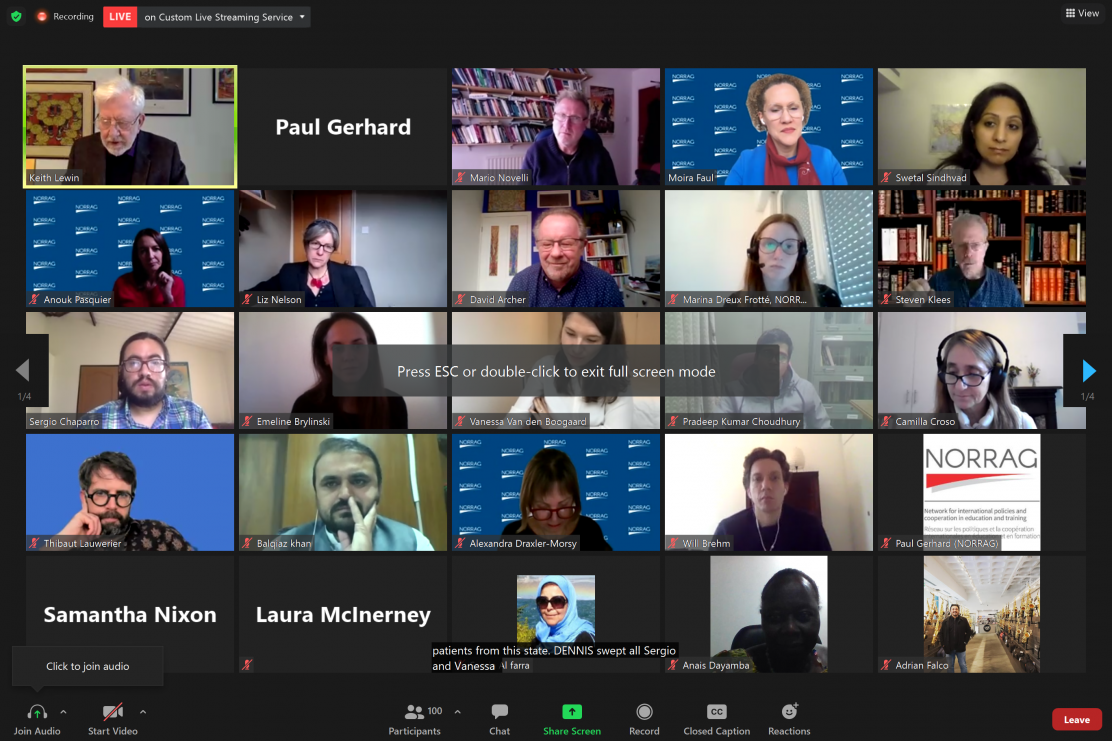

The event was introduced and moderated by Moira V. Faul, Executive Director at NORRAG. It brought together approximately 130 academics, professionals, and advocates from all over the world.

David Archer, guest-editor of NSI 05 and Head of Public Services at ActionAid, kicked off the event by reminding us of the importance of the discussion. Billions of tax dollars go un-accessed every year, affecting the funding available for equitable education. He stressed that the education community needs a deeper understanding of tax to build political will and a commitment to investments in public education.

David Archer, guest-editor of NSI 05 and Head of Public Services at ActionAid, kicked off the event by reminding us of the importance of the discussion. Billions of tax dollars go un-accessed every year, affecting the funding available for equitable education. He stressed that the education community needs a deeper understanding of tax to build political will and a commitment to investments in public education.

Next, experts offered global perspectives. Liz Nelson, Director, Tax Justice & Human Rights, Tax Justice Network, United Kingdom, argued that progressive tax reforms must be prioritized to enhance the social contract between governments and citizens. Steven J. Klees, Professor of International Education Policy, University of Maryland, US, argued that the education crisis calls for a stronger commitment from the global North to the South. Last, Dennis Sinyolo, Africa Director, Education International, proposed that tax justice and budget tracking can help us unlock more resources, ensure proper teacher salaries/working conditions, and help work toward inclusive education, especially for girls and those in rural areas.

To illustrate the significant relationship between tax justice and education, experts presented evidence from the global South. Swetal Sindhvad, Executive Director, i3Development, Cambodia stressed that in Cambodia, progress has been made in tax revenue collection, however, it disproportionately benefits higher socioeconomic populations. Sergio Chaparro Hernandez, Program Officer, Centre for Economic and Social Rights, USA highlighted disparities on the ground, especially for indigenous children in Peru. Last, Vanessa van den Boogaard, Senior Research Fellow, International Centre for Tax and Development, University of Toronto, Canada, reported on the case of Sierra Leone where households are spending more than the government to access education. Progressive tax reforms are needed so that distributional inequality lessens.

The session then concluded with a discussion led by Camilla Croso, Director of Education, Open Society Foundations. She stated that strengthening funding sources for public education is key to reach education development goals. She suggested that education dialogues should also intersect with those who work on other social rights issues, such as Public Health, so a balance can be achieved in tax justice and government spending. Keith Lewin, Emeritus Professor of International Development and Education, University of Sussex, UK, added to the discussion by emphasizing that meeting SDG 4 cannot be done without shifting the needle on domestic tax systems.

A question and answer session, led by NORRAG’s Research Associate, Emeline Brylinski, followed afterwards. Various questions were raised regarding the role of social movements in tax justice and the history of government spending on education, to name a few.

http://https://vimeo.com/484056242

Programme

|

Welcome Moira V. Faul, Executive Director, NORRAG |

|

Introduction David Archer, Head of Public Services, ActionAid, UK |

|

Global Perspectives Liz Nelson, Director, Tax Justice & Human Rights, Tax Justice Network, United Kingdom Steven J. Klees, Professor of International Education Policy and Distinguished Scholar-Teacher, University of Maryland, United States Dennis Sinyolo, Africa Director, Education International, Ghana |

|

Country studies Cambodia: Swetal Sindhvad, Executive Director, i3Development, Cambodia Peru: Sergio Chaparro Hernandez, Program Officer, Centre for Economic and Social Rights, USA Sierra Leone: Vanessa van den Boogaard, Senior Research Fellow, International Centre for Tax and Development, University of Toronto, Canada |

|

Discussants Camilla Croso, Director of Education, Open Society Foundations Keith Lewin, Emeritus Professor of International Development and Education, Centre for International Education, University of Sussex, UK |

|

Q&A with the audience Emeline Brylinski, Research Associate, NORRAG, Switzerland |